Published in CondoBusiness in 2013

One of the most important resources available to the Board of Directors is the Reserve Fund Study. This document, prepared by an engineering firm every three years, covers the major physical projects that the corporation will have to carry out for the next 30 years. It outlines which items in the building need to be replaced, when they need replacement, and what the approximate cost will be at that time. Most importantly, it tells the Board how much money needs to be contributed into the Reserve Fund throughout this period in order to make all of this work possible.

With a good Reserve Fund Study, Board members can plan their major projects well in advance, rather than wait to the last minute when something goes wrong. While there will always be unexpected breakdowns and problems, this can go a long way towards eliminating special assessments and keeping maintenance fees low. On the other hand, a Reserve Fund Study that is poorly planned out can have the reverse effect. Either the Board will drop the plan and turn to a more reactionary position, leaving them financially vulnerable to any major breakdowns, or the corporation will follow the plan and quickly find that it does not have enough money to cover their expenses. In both scenarios the corporation is far more likely to find itself in financial trouble, and to raise fees to compensate.

The trick to creating a good Reserve Fund Study is to include elements of both engineering and financial planning. The plan must be able to cover all of the necessary repairs and replacements that will come up, but must also be realistic and easy to follow. For example, the plan should always keep a high enough minimum balance in the Reserve Fund to cover unexpected breakdowns. Dropping the balance to lower levels can put the corporation at risk of being caught unable to pay for a sudden expense. Similarly, if the engineer has called for the replacement of an item that could last for several more years, the corporation may end up overspending.

Most firms focus mainly on the engineering side of the equation, leaving the Board or the Management Company to deal with any financial consequences. A good engineering firm will work with the condominium to create a plan that satisfies both parties, but the corporation must first know what to look for. The following are some tips to creating the perfect plan:

Interest Rates

One of the more important numbers in the Reserve Fund Study is the assumed interest rate. While most of the revenue coming into the fund is from the maintenance fees, a significant portion also comes from interest. In smaller corporations the revenue is less significant, but for corporations with over a million dollars sitting in the fund or in GICs, this can account for tens of thousands of dollars per year. For example, with $1,000,000 in the fund, the difference between a rate of 2% and 4% is $20,000 per year! It is very important that this rate is not exaggerated, as these differences can add up over time, and the corporation may find itself with far less money than expected. The inflation rate works in the opposite way, and must also be as accurate as possible.

The Expense Curve

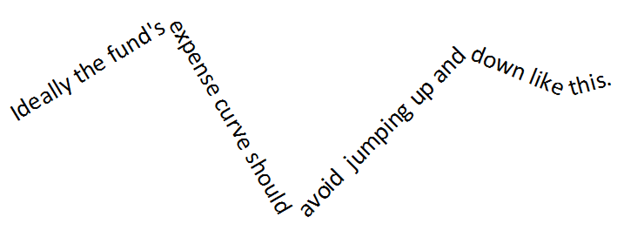

Oftentimes, the items that come up for replacement in the Reserve Fund Study are based solely on predicted life expectancy. For example, a boiler may be due for replacement because it is only expected to last 20 years, when in reality it could last another five to ten. When items are planned according to life expectancy, they tend to come up for replacement around the same time. This can create a spike in the planned expenditures, and a corresponding dip in the fund’s balance. A good plan will have an expense curve that is as level as possible, excluding the necessary increases to account for inflation. This can be achieved by moving items from year to year to try and “flatten” the curve. Aesthetic items can easily be moved, but even structural projects and machinery can be shifted around if the corporation can prove that this is feasible.

Avoiding these spikes can have profound effects on the maintenance fees, as the Board does not have to increase fees or special assess to cover any one spike. This also creates a system in which the costs of maintaining the building are shared evenly by all owners, regardless of when they move into the building.

Timing of Aesthetic Projects

The Reserve Fund Study takes all major items into account, including aesthetic projects. Although these do not have any structural or mechanical function, they improve the look and feel of the building and help to keep unit values high. A good plan will spread out these projects so that there are new upgrades happening every few years in the building.

If created properly, the Reserve Fund Study can offer the Board of Directors a lot of bang for their buck. A good plan will help eliminate the need for special assessments, have the capacity to handle emergencies, keep owners happy with regular aesthetic improvements, and save the building money by ensuring that projects are only carried out when necessary. It is strongly recommended that you use an engineering firm that is flexible and willing to work with the corporation to create a plan that is right for your building’s needs.